Transform Your Business with the Right Payment Processor

More than meets the eye

Swipe your credit card, grab a receipt. Type in some numbers, receive an order confirmation. As a consumer, it’s easy to run your errands and do your online shopping without thinking about how a credit card transaction actually works. But as a small business owner, understanding the process is key to choosing the best accounting solutions and keeping your costs as low as possible.

Every credit card transaction involves several different entities: the cardholder (or customer), the merchant (or business), the network, the bank that issued the card to the cardholder, the card brand, and the payment processor.

When payment information is exchanged between the cardholder and the merchant, the network routes that information to the card-issuing bank for authorization. The network clears the transaction, and at the end of the day it collects funds for all the transactions that occurred in a given 24-hour time frame.

The card brands—Visa, Mastercard, Discover, American Express, etc.—regulate the industry with standards and fees and establish channels through which information passes. For the services they provide, card brands exact payment in the form of assessment charges. The network leverages authorization fees, and the card-issuing bank imposes interchange rates. It falls to the merchant to pay these processing fees, which can add up to a significant percentage of your credit card sales.

It doesn’t have to be that way

There’s only so much you can do to alleviate the pressure of credit card processing fees, but streamlining your accounting procedures and integrating a trustworthy payment processing platform can transform your business, save you time and money, and prevent headaches.

Manual invoicing and accounting is a long, tedious, error-plagued process. Cloud-based accounting or ERP software, like Kechie ERP by My Office Apps, simplifies small business operations by providing an easily accessible information hub from which users can quickly retrieve accurate information. Rather than storing sensitive information in filing cabinets, toggling between numerous spreadsheets, and manually tracking inventory, you and your team can manage your logistics in one secure location.

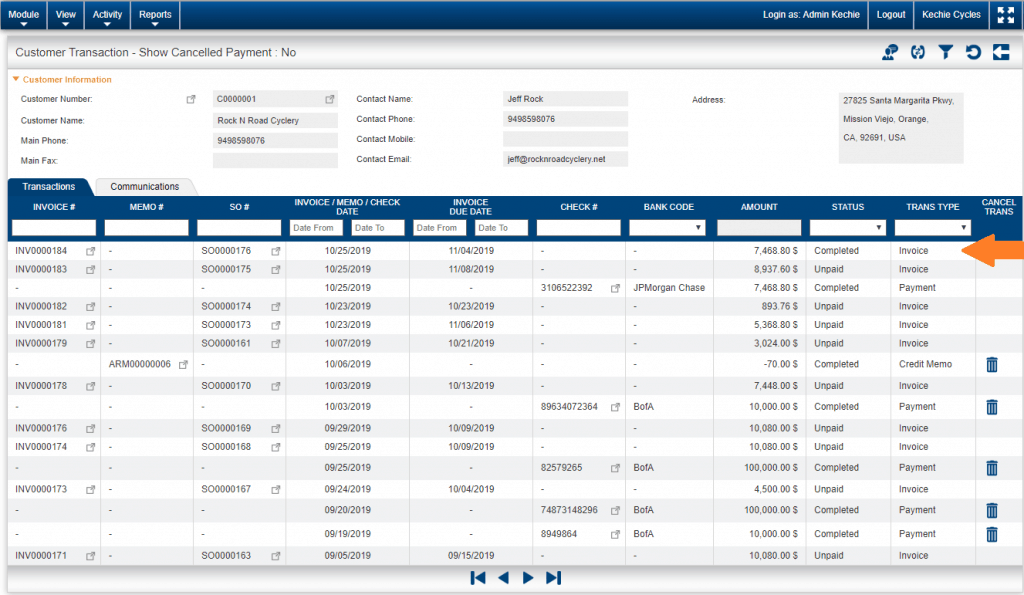

Even with accounting software, however, invoicing remains a pain point. Merchants have to create an invoice, run the transaction through their virtual terminal, create a cash receipt, find the invoice, and, finally, post the payment to the invoice. That’s a lot of time-consuming steps! And the more steps there are, the more potential there is for data entry error.

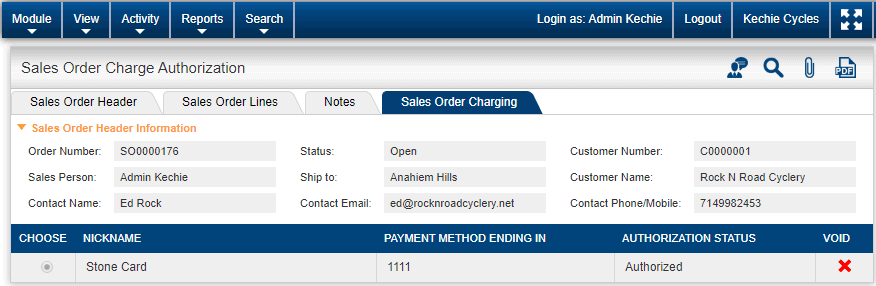

Enter the sixth entity in the transaction process: the payment processor. Some processors provide an integrated payment application, which automates the invoicing process, automatically posts payments to invoices, and updates your general ledger to keep your records accurate and eliminate the need for duplicate data entry.

The payment application integrates directly with your accounting or ERP software for a simple, seamless transaction experience. Some payment applications can even save you money by lowering your interchange rate and qualifying you for reduced processing fees. And if you choose a processor that offers an online customer payment portal, your customers can pay their invoices on their own time.

Look before you leap

A wide array of companies offer payment integrations, and they each tout their own list of enticing promises—attached to complicated conditions and ensnared in industry jargon. How do you know which companies you can trust to deliver?

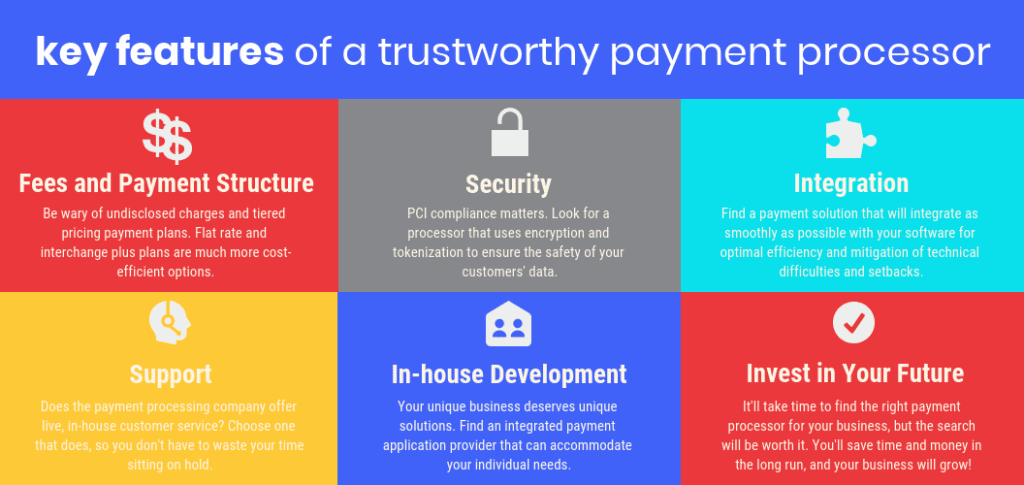

Here are five key features to look for to help you choose the best payment processor for your business.

- Fees and payment structure: Many processors will tempt you with low costs, but they’re probably not being upfront about additional charges or shoddy customer service. If it sounds too good to be true, there’s a good chance it is. Ask for a cost savings analysis and be wary of tiered pricing payment plans. Flat rate and interchange plus plans are much more transparent and likely to lower your processing rates. Long-term contracts are giant red flags. Reputable companies are confident in their product and committed to earning your business month after month by providing continual value and excellent customer service.

- Security: Just because you’re a small business doesn’t mean you can fly under the radar. If you process credit cards, you need to maintain PCI compliance to keep your customers’ data protected. Look for a payment processor that implements encryption, tokenization, and off-site data storage. Additionally, a processor that offers Level 3 processing can save you money on interchange fees by lowering your risk of fraud.

- Integration: When you have a small team, you need your business tools to work as efficiently as possible. A payment solution should integrate smoothly with your accounting software to minimize the time your employees need to spend on payment collection and avoid technical difficulties. Best-case scenario: Find an integration built specifically for your software, like EBizCharge for Kechie ERP.

- Support: No one wants to waste valuable time sitting on hold, waiting to talk to a support team that may not be based in the United States. Ask a potential processing provider what kind of customer service they offer. It’s worth taking the time to find in-house, live support.

- In-house development team: Your business is unique, and your payment processor should be willing to accommodate your individual needs when it comes to your integrated payment application. In-house development teams can offer you customization options and fix bugs to prevent a minor snag from becoming a major setback.

Using an integrated payment application with your accounting or ERP software can revolutionize your workflows and lower your processing fees—if you invest the time and resources in finding the best option for your business. The more you know about credit card transactions, associated fees, and the functions of the processor and integrated payment application, the better equipped you’ll be to make a smart decision. Don’t be discouraged by the search! Your business deserves a payment processor that will help it reach its full potential.